Not known Incorrect Statements About Pacific Prime

Table of ContentsFacts About Pacific Prime Uncovered7 Easy Facts About Pacific Prime ShownEverything about Pacific PrimeA Biased View of Pacific PrimeAll About Pacific Prime

Insurance is an agreement, represented by a policy, in which an insurance policy holder gets financial protection or repayment against losses from an insurance provider. The firm pools customers' threats to make repayments extra inexpensive for the guaranteed. The majority of people have some insurance coverage: for their cars and truck, their residence, their medical care, or their life.Insurance coverage additionally helps cover expenses associated with obligation (legal responsibility) for damage or injury triggered to a 3rd party. Insurance policy is a contract (plan) in which an insurance company compensates an additional versus losses from specific contingencies or hazards.

Investopedia/ Daniel Fishel Several insurance coverage policy kinds are offered, and basically any kind of private or organization can locate an insurance policy business eager to guarantee themfor a rate. Most people in the United States have at least one of these kinds of insurance coverage, and car insurance is needed by state legislation.

Pacific Prime for Dummies

Locating the price that is best for you needs some research. Optimums may be established per duration (e.g., annual or policy term), per loss or injury, or over the life of the policy, additionally known as the lifetime maximum.

Plans with high deductibles are commonly less costly due to the fact that the high out-of-pocket expenditure generally causes less small claims. There are several sorts of insurance policy. Allow's take a look at the most essential. Medical insurance helps covers routine and emergency situation healthcare expenses, frequently with the alternative to include vision and oral solutions independently.

Several precautionary solutions might be covered for free before these are fulfilled. Health insurance coverage might be acquired from an insurance policy company, an insurance coverage agent, the federal Health Insurance coverage Market, offered by a company, or government Medicare and Medicaid coverage.

The Greatest Guide To Pacific Prime

Rather than paying of pocket for car mishaps and damages, individuals pay yearly premiums to a car insurance coverage company. The company after that pays all or a lot of the covered prices connected with a car crash or various other car damages. If you have actually a leased lorry or obtained money to acquire a vehicle, your lender or renting car dealership will likely need you to carry vehicle insurance policy.

A life insurance policy plan assurances that the insurance provider pays an amount of cash to your recipients (such as a spouse or children) if you die. In exchange, you pay costs during your life time. There are 2 find here primary sorts of life insurance coverage. Term life insurance covers you for a details period, such as 10 to two decades.

Long-term life insurance policy covers your whole life as long as you proceed paying the costs. Traveling insurance covers the costs and losses related to taking a trip, consisting of trip terminations or delays, insurance coverage for emergency situation healthcare, injuries and discharges, harmed baggage, rental cars, and rental homes. Even some of the ideal traveling insurance coverage business do not cover terminations or delays because of weather, terrorism, or a pandemic. Insurance is a way to handle your economic threats. When you get insurance, you acquire defense versus unexpected monetary losses.

Pacific Prime Things To Know Before You Get This

Although there are numerous insurance policy kinds, a few of the most usual are life, health, home owners, and vehicle. The appropriate type of insurance coverage for you will depend upon your goals and economic circumstance.

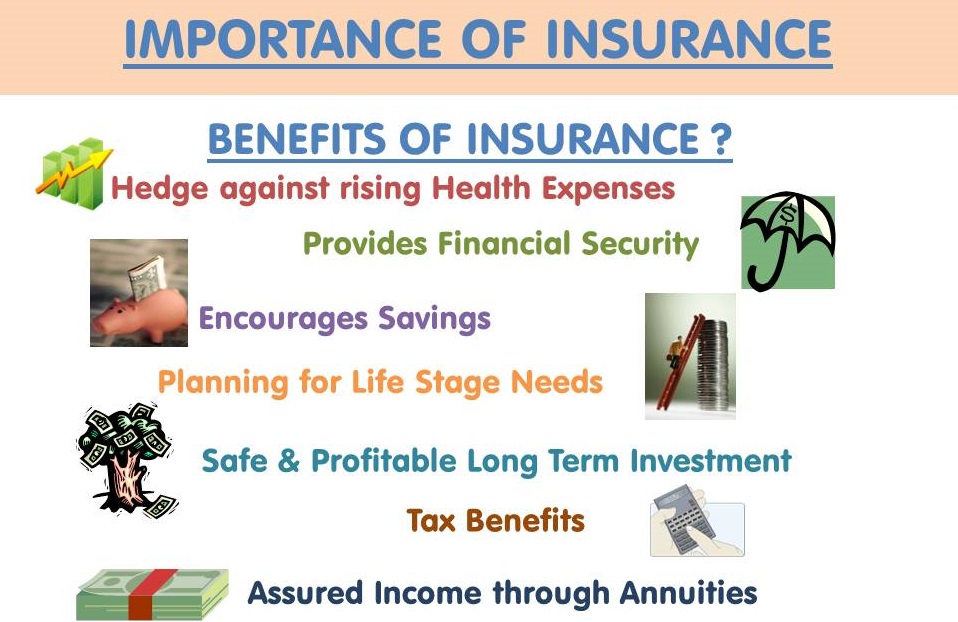

Have you ever before had a moment while considering your insurance plan or searching for insurance policy when you've thought, "What is insurance policy? And do I really require it?" You're not alone. Insurance policy can be a mysterious and confusing thing. How does insurance job? What are the advantages of insurance policy? And exactly how do you locate the very best insurance policy for you? These are usual inquiries, and thankfully, there are some easy-to-understand solutions for them.

Suffering a loss without insurance coverage can put you in a tough economic scenario. Insurance is a vital economic tool.

Excitement About Pacific Prime

And in many cases, like auto insurance and employees' payment, you may be called for by regulation to have insurance policy in order to shield others - maternity insurance for expats. Learn more about ourInsurance choices Insurance coverage is essentially an enormous nest egg shared by lots of people (called insurance holders) and taken care of by an insurance coverage copyright. The insurer uses cash collected (called costs) from its insurance holders and various other financial investments to pay for its operations and to accomplish its pledge to policyholders when they sue